What we heard: insights from clients and prospective clients

This fall, RGS partnered with Probolsky Research to survey more than 100 public agencies to better understand the current issues and trends—and to help enrich RGS services to current and future partners.

Public agencies are heading into a year defined by change, constraint, and capacity gaps

Across current clients and prospective agencies alike, the story of the next 12 months is consistent: public sector organizations are being asked to do more with less, while navigating significant internal and external change. Three trends rise to the top.

- Fiscal pressure is the backdrop for everything

Agencies identify budget constraints as a leading near-term challenge. This matters because budget stress doesn’t just reduce spending; it reshapes decisions. Agencies look for solutions that (a) reduce risk, (b) avoid long hiring timelines, and (c) stretch existing teams rather than replace them.

- Internal capacity is thin — and getting thinner

Many agencies noted limited internal capacity and lack of internal training among their top challenges in the year ahead.

That combination may be a warning light. Agencies aren’t only short-staffed; they also need more time and structure to equip staff. Even well-resourced agencies may struggle to go beyond delivering basic services.

- Organizational change requires attention

Another top trend emerged for 2026 — managing organizational change. These changes may include: turnover, reorganizations, new regulations, or shifting community expectations. Navigating them isn’t simple, especially in government settings that can be change-averse.

What agencies say they need most from outside support

Given those pressures, agencies are looking for help that protects core operations while enabling strategic movement.

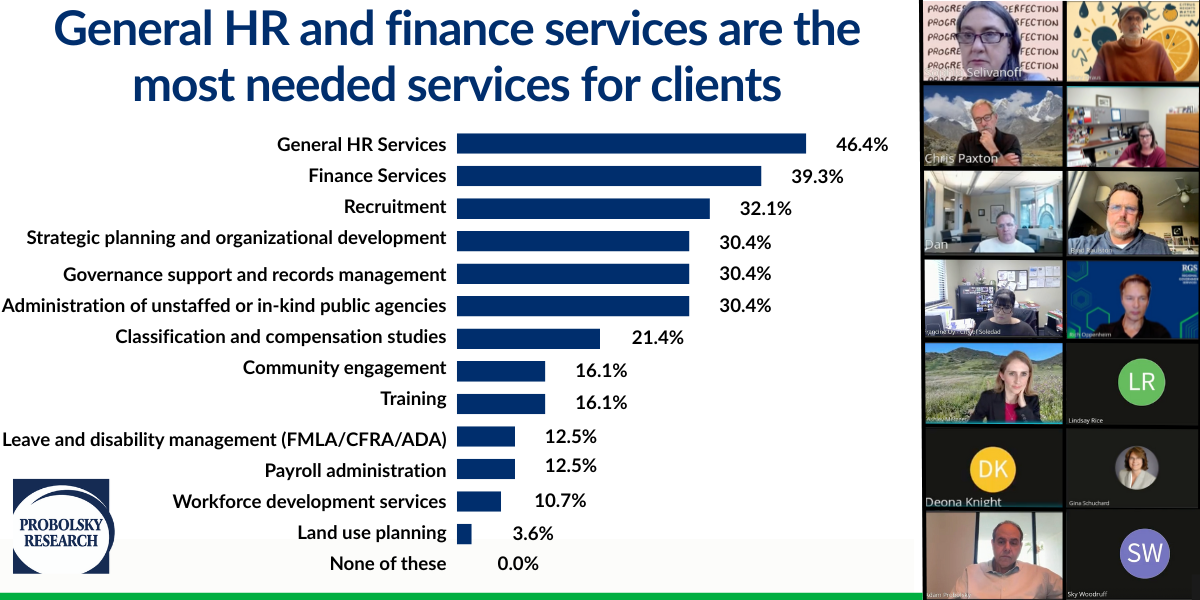

Foundational support: HR and finance remain mission-critical

Current RGS clients most frequently point to general HR and finance services as the most necessary external supports for agencies like theirs.

These aren’t “nice to haves.” They’re the backbone functions that keep an organization compliant, staffed, and solvent — especially when internal bandwidth is stressed.

Key projects are a major prospect demand area

Among those RGS hasn’t partnered with, the top areas identified for consulting support included:

- Classification/compensation studies

- Strategic planning

Local agencies want to better leverage grants

Agencies also flag grant strategy and grant administration as services they would value. RGS plans to host a webinar in February to share more resources and best practices related to grant readiness for local governments. Subscribe to our newsletter to get registration information.

Where we heard about RGS

Agencies value public-sector fluency

Clients said the top reason RGS felt like the right fit is its understanding of public sector operations. That specific differentiator speaks directly to the change-and-capacity moment agencies are living through: they don’t just need consultants; they need partners who already operate in the same constraints and governance reality.

Service performance is strong

Client ratings show:

- 95% positive overall experience

- 98% say services are valuable

In a high-pressure environment, reliability becomes strategy. Those numbers suggest RGS is already functioning as the kind of dependable back-office and project support partner agencies are seeking.

Awareness still travels through relationships

Clients primarily learn about RGS through referrals or incumbency (“RGS was already a contractor when they joined”). Word-of-mouth is powerful because it is trust-based, but it can cap growth if it remains the dominant pipeline. In a market where needs are expanding, visibility matters.

Agencies see RGS’ JPA structure as an advantage

Among those who haven’t worked with RGS yet, 60% view its JPA status as an advantage, with 41% calling it a significant advantage. This speaks to the trust that local governments place in public service.

What this all points to

The research indicates:

- The public sector is entering a tough year defined by budget limits, shrinking capacity, and rapid change.

- Agencies are prioritizing support that stabilizes core operations (HR/finance) and tackles foundational projects (classification & compensation, strategic planning).

- Grants support is a clear adjacent need area as agencies chase solutions that don’t drain their communities.

- RGS is well aligned to the moment because agencies trust its public-sector fluency and rate its value highly — but growth will require wider awareness and procurement-friendly packaging.

Share this article

Stay Up-To-Date - Follow RGS on LinkedIn:

Latest articles

February 10, 2026

February 10, 2026

February 10, 2026